Is Mileage Allowance Taxable . Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. But if you provide more In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web the business mileage rate for 2024 is 67 cents per mile. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. You may use this rate to reimburse an employee for business use. Web is mileage reimbursement taxable? Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the.

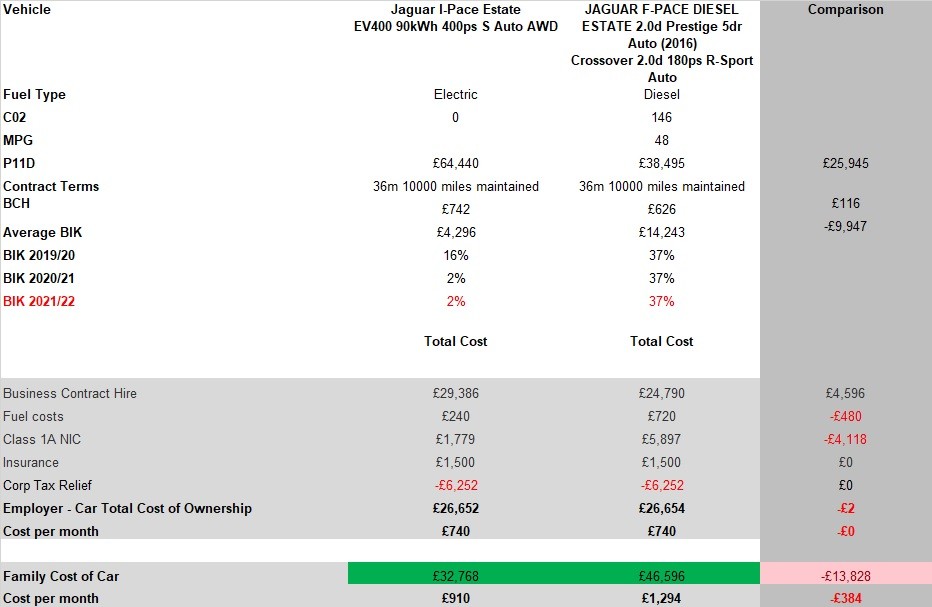

from www.letstalkleasing.co.uk

In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web the business mileage rate for 2024 is 67 cents per mile. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. You may use this rate to reimburse an employee for business use. But if you provide more Web is mileage reimbursement taxable? Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the.

Should you take a Company Car or a Car Allowance?

Is Mileage Allowance Taxable In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web is mileage reimbursement taxable? You may use this rate to reimburse an employee for business use. In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web the business mileage rate for 2024 is 67 cents per mile. But if you provide more Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use.

From irs-mileage-rate.com

Government Mileage Calculator IRS Mileage Rate 2021 Is Mileage Allowance Taxable Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. Web the business mileage rate for 2024 is 67 cents per mile. You may use this rate to reimburse an employee for business use. Web is mileage reimbursement taxable? But if you provide more Web learn how the irs determines. Is Mileage Allowance Taxable.

From www.tripcatcherapp.com

AMAPS Tax Free Mileage Allowance Tripcatcher Is Mileage Allowance Taxable You may use this rate to reimburse an employee for business use. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. But if you provide more Web you must. Is Mileage Allowance Taxable.

From www.change.org

Petition · Raise the tax free allowance on fuel mileage for business Is Mileage Allowance Taxable In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. But if you provide more You may use this rate to reimburse an employee for business use. Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. Web learn how the irs determines. Is Mileage Allowance Taxable.

From deborahsharan.blogspot.com

Car allowance tax calculator DeborahSharan Is Mileage Allowance Taxable Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. Web the business mileage rate for 2024 is 67 cents per mile. But if you provide more You may use. Is Mileage Allowance Taxable.

From www.mburse.com

2024 Everything You Need To Know About Car Allowances Is Mileage Allowance Taxable Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. Web the business mileage rate for 2024 is 67 cents per mile. Web is mileage reimbursement taxable? Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. Web learn how. Is Mileage Allowance Taxable.

From payadvice.uk

Approved Mileage Allowance Payments error PAYadvice.UK Is Mileage Allowance Taxable Web the business mileage rate for 2024 is 67 cents per mile. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. But if you provide more Web learn how. Is Mileage Allowance Taxable.

From triplogmileage.com

Is Car Allowance Taxable? Keep Car Allowance TaxFree Guide Is Mileage Allowance Taxable Web is mileage reimbursement taxable? Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. But if you provide more You may use this rate to reimburse an employee for business use. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how. Is Mileage Allowance Taxable.

From pro-taxman.co.uk

Mileage allowance payments the maximum taxfree amount Pro Taxman Is Mileage Allowance Taxable Web the business mileage rate for 2024 is 67 cents per mile. You may use this rate to reimburse an employee for business use. Web is mileage reimbursement taxable? Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. In general, mileage reimbursements are not taxable if they follow irs. Is Mileage Allowance Taxable.

From www.peoplekeep.com

Is employee mileage reimbursement taxable? Is Mileage Allowance Taxable Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. You may use this rate to reimburse an employee for business use. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. Web is mileage reimbursement taxable? But if you. Is Mileage Allowance Taxable.

From www.irstaxapp.com

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified Is Mileage Allowance Taxable In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web the business mileage rate for 2024 is 67 cents per mile. You may use this rate to reimburse an employee for business use. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to. Is Mileage Allowance Taxable.

From dxozleblt.blob.core.windows.net

What Is Maximum Mileage Allowance at Amanda Glover blog Is Mileage Allowance Taxable Web is mileage reimbursement taxable? Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web the business mileage rate for 2024 is 67 cents per mile. But if you provide more Web. Is Mileage Allowance Taxable.

From triplogmileage.com

Is Car Allowance Taxable? Keep Car Allowance TaxFree Guide Is Mileage Allowance Taxable Web is mileage reimbursement taxable? But if you provide more In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. Web the business mileage rate for 2024 is 67 cents per mile. You. Is Mileage Allowance Taxable.

From www.youtube.com

How to Track Mileage for Taxes Bookkeeping 101 YouTube Is Mileage Allowance Taxable In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. Web the business mileage rate for 2024 is 67 cents per mile. Web learn how car allowances are taxed as income or deductions. Is Mileage Allowance Taxable.

From yokoy.io

Mileage Allowance Payments Complete Guide [2024] Yokoy The AI Is Mileage Allowance Taxable But if you provide more Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. Web the business mileage rate for 2024 is 67 cents per mile. You may use. Is Mileage Allowance Taxable.

From listentotaxmanusa.com

How to claim mileage allowance when you are selfemployed Tax Guides Is Mileage Allowance Taxable Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. Web you must not have claimed the special depreciation allowance on the car, and you must not have claimed actual. But if you provide more In general, mileage reimbursements are not taxable if they follow irs rules (which we will. Is Mileage Allowance Taxable.

From www.ukpropertyaccountants.co.uk

Taxable Benefits The Role of P11D and P11D(b) Forms Is Mileage Allowance Taxable Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. But if you provide more Web is mileage reimbursement taxable? Web the business mileage rate for 2024 is 67 cents per mile. In general, mileage reimbursements are not taxable if they follow irs rules (which we will get to. You. Is Mileage Allowance Taxable.

From exomvzzvq.blob.core.windows.net

What Mileage Allowance Can I Claim at Ola Delreal blog Is Mileage Allowance Taxable You may use this rate to reimburse an employee for business use. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. But if you provide more Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. In general, mileage. Is Mileage Allowance Taxable.

From taxscouts.com

Mileage Allowance TaxScouts Taxopedia Is Mileage Allowance Taxable Web the business mileage rate for 2024 is 67 cents per mile. Web is mileage reimbursement taxable? Web learn how car allowances are taxed as income or deductions depending on the type, amount, and purpose of the. Web learn how the irs determines the mileage allowance for business, medical, charity, and moving purposes, and how to use. But if you. Is Mileage Allowance Taxable.